child tax credit 2022 calculator

Partial Expanded Child Tax Credit. The reliability of the results depends on the accuracy of the information.

Child Tax Credit In 2022 Is Your State Sending 750 To Parents Find Out Now Cnet

Length of residency and 7.

. Your amount changes based on the age of your children. The price rose to 3600 for kids under the age of six. You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be.

The following amounts are for the payment period from July 2022 to June 2023 and are based on your AFNI from 2021. Tax Changes and Key Amounts for the 2022 Tax Year. Overview of child and family benefits.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. The maximum child tax credit amount will decrease in 2022.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The payments for the ccb young child supplement are not reflected in this calculation. Vereniging van Verpleegkundigen Suriname.

For children under 6 the amount jumped to 3600. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying. Prior to the american rescue plan parents could only.

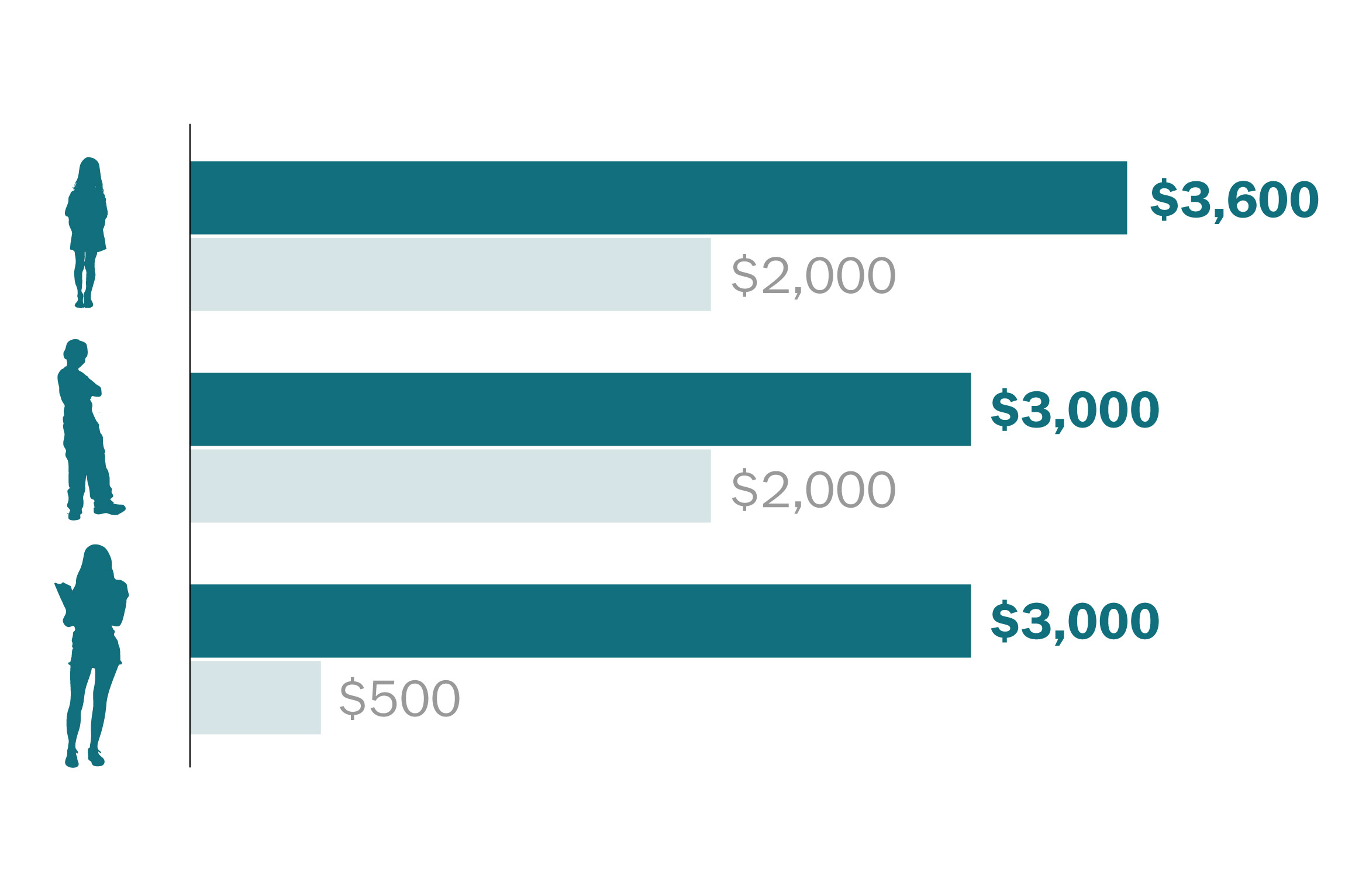

The Child Tax Credit offers a credit of up to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 for 2021. Estimate Your 2021 Child Tax Credit Advance Payments. Ad Free means free and IRS e-file is included.

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Dare to Compare Now. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income. For 2022 that amount reverted to 2000 per child dependent 16 and younger. The credit will be fully refundable.

Child tax credit 2022 calculator. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit.

Use the child and family benefits calculator to help plan your budget. The first one applies to the extra credit amount added to. Wednesday April 6 2022.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. At the 6 to 17 years of age rate for the month of april 2022. The child tax credit for tax years 2022 and onward will revert back to pre-2021 rules.

The American Rescue Plan made the Child Tax Credit accessible to 17-year-olds. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021. For 2018 - 2021 Returns the ACTC is worth up to 1400.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. Qualified Adoption Expenses.

The credit for qualified adoption expenses as well as the special credit for. If your MAGI is over 75000 the credit is phased. Any excess advance child tax credit payments do need to be paid back IRS.

The 2021 advance was 50 of your child tax credit with the rest on the next years return. Child Tax Credit 2022 Calculator. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

Tax credits and benefits for individuals. If your tax is 0 and your total earned income is at. Families may obtain a refund for any surplus funds if the credit surpasses the amount of taxes due.

You andor your child must pass all seven to claim this tax credit. Start Child Tax Credit Calculator. Max refund is guaranteed and 100 accurate.

Discover Helpful Information And Resources On Taxes From AARP. In addition instead of being paid out in full at tax time the credit will be made accessible every quarter beginning as early as July. Calculate how much you can get.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. Under the American Rescue plan the Child Tax Credit was increased from 2000 to 3000 and 3600 per child for children over and the age of six respectively. The IRS is no longer issuing these advance payments.

Have been a US. Previously only children under the age of 16 qualified. The credits reach has been expanded.

As of 2022 the cap for dependents 16 and. Our child tax credit calculator will help you estimate your refundable child tax credit. As of 2021 individuals with kids ages 6 to 17 were eligible for a tax benefit equal to 3000.

Find more information on 2022 Refundable Child Tax Credits. 2022 Child Tax Credit Calculator. This calculator is available for your convenience.

Dont get TurboCharged or TurboTaxed. Facebook page opens in new window.

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Family Tax Benefit Calculator Store 52 Off Www Ingeniovirtual Com

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

September Child Tax Credit Payment How Much Should Your Family Get Cnet

The Child Tax Credit Hurry Up Macg Magazine

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Canada Child Benefit Ccb After Separation No Cra Audit

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Canada Child Benefit Calculator Ativa Interactive Corp

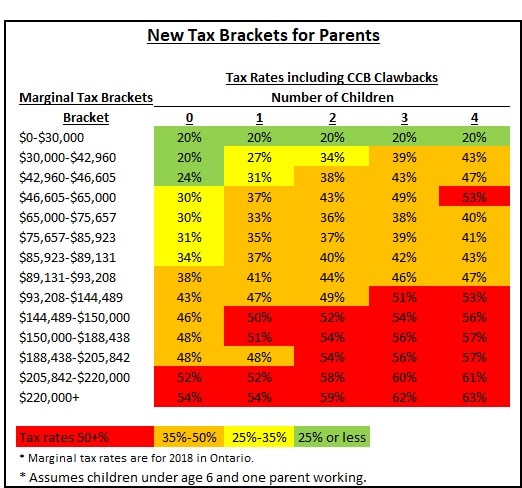

Canada Child Benefit The Hidden Tax Rate Planeasy

Family Tax Benefit Calculator Store 52 Off Www Ingeniovirtual Com

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Credit Definition How To Claim It

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Tax Credit Calculator Sunnybrook Foundation

September Child Tax Credit Payment How Much Should Your Family Get Cnet